Making rethinking our behaviour as accessible as a piece of string

Paul Seward is the founder of FIPS Africa in Nairobi; an NGO that is focused on increasing the productivity of smallholder farmers in East Africa. One of their key challenges is how to help farmers growing maize to change the way they grow it – it’s an excellent crop, that food scientists have made even easier through better pest-resistant seed coatings, but persistent bad farming practices have undermined the farmers’ ability to take advantage of it.

Farmers in Makueni helped by FIPS-Africa

So Seward has instituted four key mechanisms to make it easier for East African farmers to beneficially change their behaviour, and take advantage of maize:

i) Make the messenger someone they already trust, not the person who knows the most about the subject

Instead of trying to educate the consumer themselves, FIPS recruit people in the villages whom the villagers already trust as their ‘village advisors’. These are the people who then share the facts about better behaviours.

ii) Make the change low risk and easy to try

FIPS produces free packs of just a few seeds for every farmer to try. They don’t have to risk giving up their existing crop – they just plant these extra seeds in a corner somewhere and see what happens.

iii) Make the change bear quick results

The crop comes through in as early as three months. A small amount of effort brings a quick and visible reward. If only all of life were like that.

iv) Make the guide to good practice as easy and accessible as a piece of string

This was the bit I was most struck by. One of the reasons maize doesn’t always come through well as a crop is that farmers are planting it in the wrong way. They put too many seeds in a single hole, meaning that none of them get the amount of water they need to flourish, and the crop fails. Oh, and there’s a tendency to put the fertilizer right on top of those seeds. Another mistake: it’s too close, and damages them.

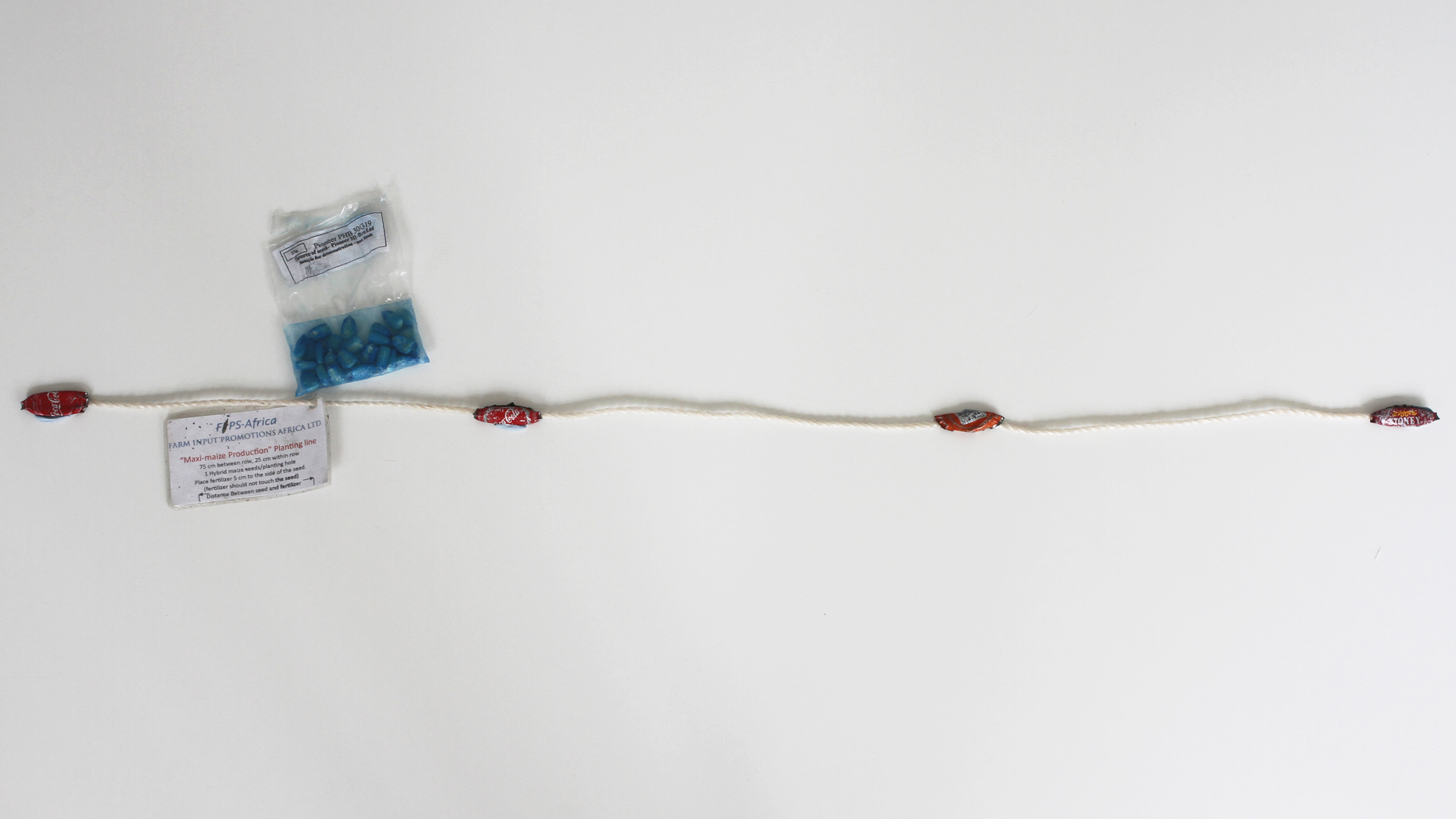

So FIPS produced this:

It’s a piece of string, with four bottle tops and a laminated business card on it. Stretch out the string, and the spacing between the bottle tops shows you how far apart to plant each of your maize seeds to allow them to draw the water they need from the arid soil of East Africa.

And the length of the card is the distance the fertiliser should be from each seed: close enough to do good, but far enough away to prevent it damaging them. And all in the reassuringly familiar language of beer and string. Brilliant.

So what’s the broader point here, for those of us who aren’t having trouble getting our maize to come up roses?

Most challengers are to some degree trying to re-educate the consumer, or at least show them there is a better way to participate in the category than they are at the moment – from the playful packaging wit of Benefit debunking the unnecessary seriousness of the cosmetics business to the theatrical symbols of re-evaluation of Elon Musk’s Tesla. In some of these categories the challenger is acting primarily in their own self-interest (they’ve got a business to run, and targets to hit); in others, they can be acting in the consumers’ best interests.

Take most financial service companies, for whom a impetus to educate their potential target market ought to be the poor and self-damaging financial behaviour most of us display. In Britain, for example, most of us should be saving twice as much as we currently are to have enough to keep us comfortable when we retire; yet when a 600 page report in March clearly spelt this out (a lot of us could be in for a very unpleasant shock in later life), it barely touched our mental sides.

So where’s the financial services challenger that’s seriously stepping up and challenging how we think about our financial behaviour, for our sake and not simply theirs? Missing in action. Ditto all those much vaunted ‘challenger banks’, most of whom are changing little, if anything, in how we really benefit from banking or our money. And one can see it might be daunting, even unpopular.

Unless, perhaps, one learnt not from other financial service challengers but an NGO boosting farming productivity: Make the messenger someone they already trust, not the person who knows the most about the subject. Make the change low risk and easy to try. Make the change bear quick results.

And make the guide to good practice as easy and accessible as a piece of string.